U.S. Propane Inventories Reach Record High in October 2023

A surge in propane production and exports leads to an abundant supply and falling prices.

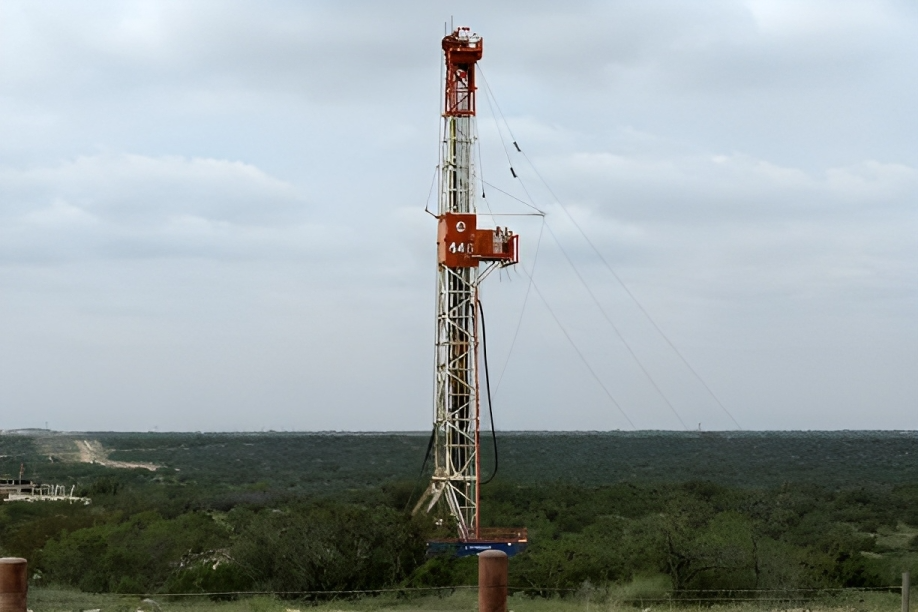

Propane inventories in the United States hit a record seasonal high at the beginning of October 2023. This surge is attributed to the rapid growth in light petroleum liquids reclaimed from the booming natural gas field production, outpacing the robust increase in exports.

As of October 6, inventories reached 102 million barrels, a notable rise from the 85 million barrels recorded a year earlier. These numbers indicate an inventory surplus of 13 million barrels, which is equivalent to a 15% increase or approximately 1.18 standard deviations above the previous seasonal average for the years 2015 to 2022. Furthermore, these inventories are just 1 million barrels short of the all-time high of 103 million, which was established in November 2015.

At the end of the winter season in 2022/23, there was an excess of around 10 million barrels compared to the seasonal average, equating to a 22% increase or approximately 0.98 standard deviations. This surplus has continued to grow despite the robust performance of exports.

Consequently, spot prices at the Mont Belvieu hub in Texas have seen a decrease, averaging just $29 per barrel in October 2023. This falls within the 33rd percentile when considering all months since 1990, adjusted for inflation.

Real prices have also witnessed a decline, dropping from an average of $37 (51st percentile) in October 2022 and a notable $67 (87th percentile) in October 2021.

The propane boom can be attributed to the substantial expansion of dry gas production, growing at an average rate of 5% since 2013. Additionally, propane recovery from gas wells has surged at a compound rate exceeding 9% annually over the past decade.

Investments in field gas processing have been pivotal in extracting premium propane for separate sales. Although U.S. petroleum refineries have consistently produced 59 million barrels of propane from January to July since 2013, domestic consumption has experienced little growth. Approximately 218 million barrels were supplied to domestic users in the first seven months of 2023, showing minimal change compared to recent years.

Instead, the surplus has been directed to international markets. Exports surged to 324 million barrels in the first seven months of 2023, a remarkable increase from the 54 million barrels recorded in the same period in 2013. The United States has thus emerged as a significant propane supplier to East Asia, Latin America, and, to a lesser extent, Europe.

Key destinations for U.S. propane exports in 2022 included Japan (138 million barrels), Mexico (58 million), China (52 million), and South Korea (42 million), collectively representing more than half of the total exports. Further shipments to the Netherlands, Singapore, Indonesia, Brazil, Belgium, Spain, and Chile contributed to over 80% of the total.

The propane surplus has substantially lowered input costs for petrochemical producers in Asia and provided cost-effective heating and cooking fuel for households in emerging markets. Despite near-record inventories, the impact on domestic heating and cooking costs has been moderate, with U.S. households currently paying an average of $101 per barrel for delivered propane, remaining close to the long-term inflation-adjusted average of $108.