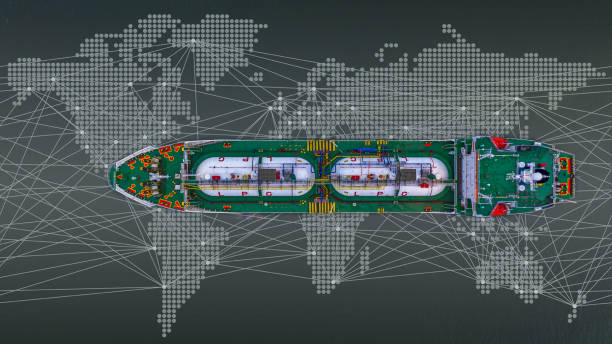

Surging U.S. Propane Exports Propel Record Highs, Fueled by Asian and European Demand

In recent years, the United States has experienced a remarkable surge in propane exports to Asia, contributing to the country reaching an all-time high in March 2023. According to the U.S. Energy Information Administration (EIA), the U.S. propane export level soared to a record-breaking 1.7 million barrels per day (bpd) in March 2023, marking the highest export level ever recorded since data collection began in 1973. Furthermore, the momentum continued in April, surpassing the previous record.

One of the key driving forces behind the increase in U.S. propane exports to Asia is the region’s growing demand for propylene, a chemical that can be derived from propane. Propylene plays a vital role in the production of polypropylene, a versatile plastic widely used in various industries.

Japan leads the pack as the primary importer of U.S. propane among Asian countries, closely followed by China and South Korea. The EIA reports that in 2022, approximately 53 percent of all U.S. propane exports were directed towards Asian markets, with the major economies in East Asia—Japan, China, and South Korea—contributing to nearly 84 percent of the propane market in the region. Notably, U.S. propane exports to China experienced significant growth, surging from 92,000 barrels per day (bpd) in March 2022 to an impressive 211,000 bpd in March 2023. Throughout the first quarter of 2023, the average daily export to China remained robust at 176,000 bpd. The upward trajectory of U.S. propane exports to China is expected to continue as the country gears up for the operation of six additional propane dehydrogenation (PDH) units in 2023, following the commencement of seven units in 2022. This expansion in PDH capacity reinforces China’s growing demand for propane and highlights its commitment to utilizing propane derivatives in various industries. As China’s thirst for propane persists, the United States stands poised to meet this escalating demand and solidify its position as a key propane supplier to the Asian market.

Europe also witnessed record-breaking levels of U.S. propane exports in the summer of 2022. Uncertainty surrounding propane supply due to Russia’s invasion of Ukraine propelled U.S. propane exports to Europe, averaging 236,000 bpd during that period, as reported by the EIA. In the first quarter of 2023, U.S. propane exports to Europe maintained a strong average of 247,000 bpd.

The surge in U.S. propane exports to both Asia and Europe signifies the growing reliance on American propane supplies to meet the demand in these regions. The robust growth in exports not only solidifies the United States’ position as a key player in the global propane market but also highlights the importance of propane as a crucial energy resource and raw material for various industries worldwide.

As the Asian market continues to expand, driven by propylene demand and the increasing number of PDH units, and with Europe seeking stable propane supplies, the United States remains well-positioned to capitalize on these opportunities. The record-breaking propane export levels demonstrate the country’s capacity to meet the evolving needs of international markets and further strengthen its economic presence in the global energy landscape.

With the ongoing demand for propane and its derivatives, the United States propane industry is poised for continued growth and is likely to play a pivotal role in shaping the global energy trade dynamics. As market conditions evolve, industry stakeholders and policymakers will closely monitor propane supply and demand trends, ensuring the stability and resilience of the propane sector while maximizing the economic benefits for the United States.